USD/CAD Hedging ideas as for July 13, 2021

After a long trend in which the US dollar weakened relative to the Canadian dollar, the US dollar began to strengthen in the last month and a half. Are we witnessing a correction or change of trend? What can a CFO or treasurer do now to hedge FX exposure?

Source: NetDania

Technically, the sharp USD appreciation in the last month and a half has been too aggressive, so it cannot be defined as a correction in a downward trend. On the other hand, not enough time has passed to identify and announce an upward trend, i.e., a change in trend.

This uncertainty is a good time for importers and exporters to examine hedging alternatives in current market conditions.

As always, we will look at the forward curve, which is a hedging benchmark for any other hedging strategy. Although this hedging instrument (forward) may not suit every company like there is no one-size-suit fits all.

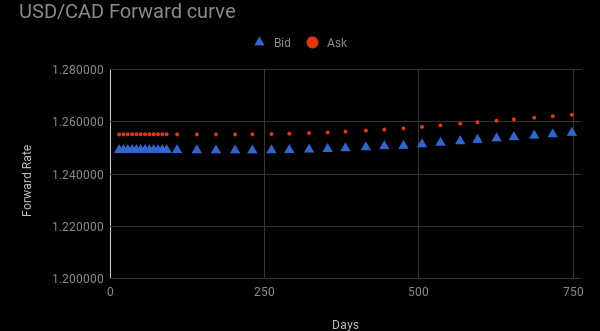

USD/CAD Forward curve as of July 13, 2021

As can be seen, the forward curve is relatively flat. This is due to a small gap between the interest rates of the two currencies.

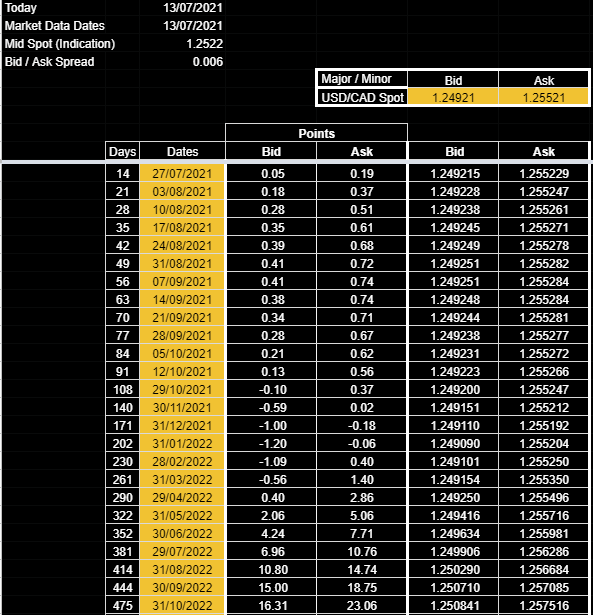

Forward table:

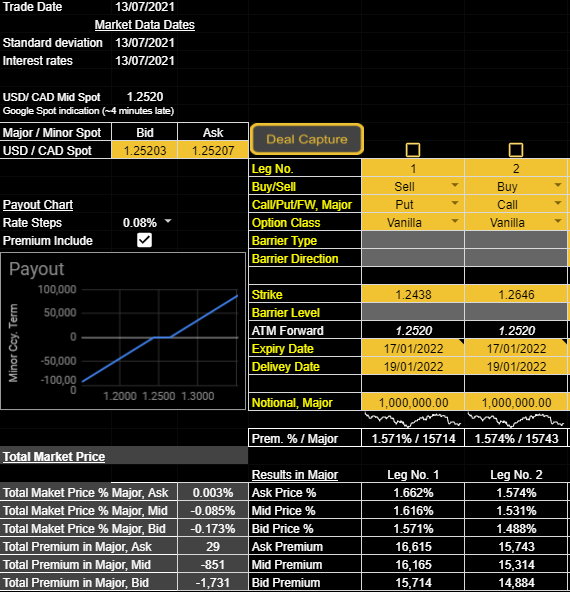

Risk reversal hedging strategy

- Exposure direction: USD appreciation against the CAD

- Spot rate when pricing: 1.252

Forward rate for a period of about six months at the time of pricing: 1.252

The strategy meaning:

- Protected rate: 1.2646. Right to buy USD and sell CAD at this exchange rate.

- Obligation rate: 1.2438. Obligation to buy USD and sell CAD at this exchange rate.

- Expiry: 6 months.

- Cost: Zero cost.

Protection in the other direction…

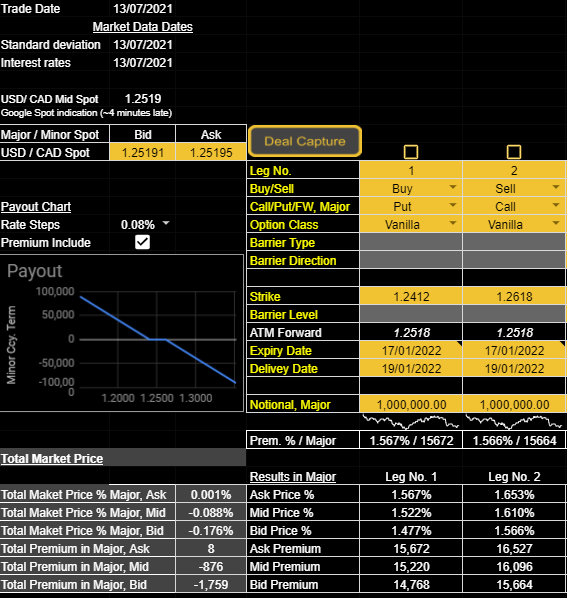

- Exposure direction: USD depreciation against the dollar

- Spot rate when pricing: 1.2519

Forward rate for a period of about six months at the time of pricing: 1.2518

The strategy meaning:

- Protected rate: 1.2412. Right to sell USD and buy CAD at this exchange rate.

- Obligation rate: 1.2618. Obligation to sell USD and buy CAD at this exchange rate.

- Expiry: 6 months.

- Cost: Zero cost.

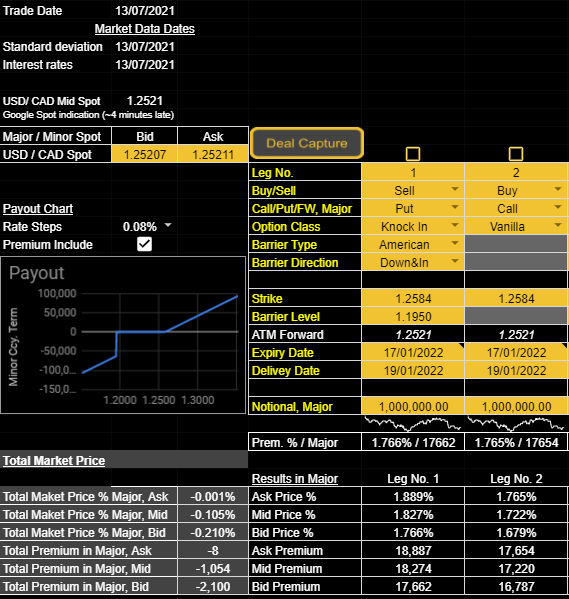

Forward extra hedging strategy

- Exposure direction: USD appreciation against the dollar

- Spot rate when pricing: 1.2521

- Forward rate for a period of about six months at the time of pricing: 1.2521

The strategy meaning:

- Protected rate: 1.2584. Right to buy USD and sell CAD at this exchange rate.

- Obligation rate: 1.2584. Conditional obligation to buy USD and sell CAD at this exchange rate.

- The Obligation will take effect if, during the strategy life, the exchange rate is traded at least once at the trigger rate of 1.195.

- Expiry: 6 months.

- Cost: Zero cost.

Protection in the other direction…

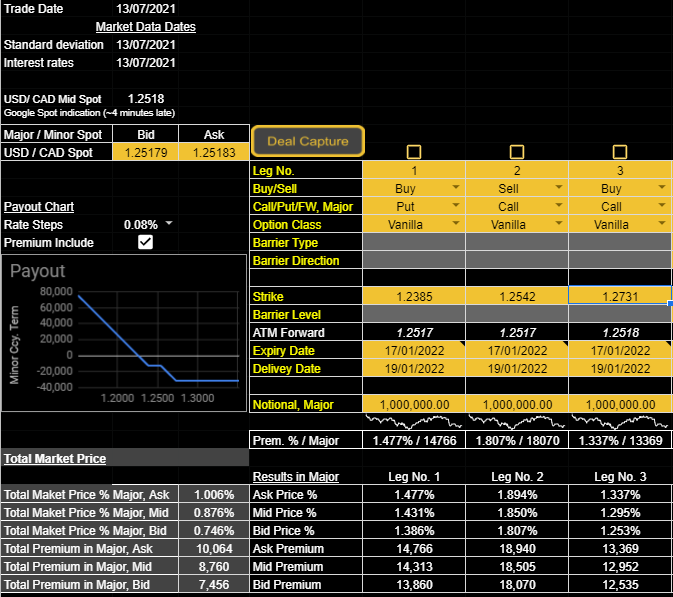

Limited loss Risk Reversal

- Exposure direction: USD depreciation against the CAD

- Spot rate when pricing: 1.2518

Forward rate for a period of about six months at the time of pricing: 1.2517

The strategy meaning:

- Protected rate: 1.2385. Right to sell USD and buy CAD at this exchange rate.

- Obligation rate: 1.2542. Obligation to sell USD and buy CAD at this exchange rate.

- Limiting the potential loss at 1.2731. The maximum loss is limited to (1.2542-1.2731)X1,000,000 USD = 18,900 CAD.

- Cost: 1%. 1,000,000 USD x 1% = 10,000 USD.

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a liquidity source for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We offer a derivative pricing calculator. We also offer policy tracker and FX derivatives inventory management tools.