GBP / USD market condition and currency hedging alternative ideas

Since the low point recorded in March 2020, the pound has strengthened against the dollar, also on the background of the dollar weakening against major currencies.

A state of a strong pound against the dollar is hurting British exporters, and the current spot rate is probably not considered attractive for new hedging operations.

In contrast, for a British importer who imports from the US and pays in dollars, the current market condition is probably very attractive for performing currency hedging operations.

Since no one really knows what direction the exchange rate will trade in the future, we will represent hedging alternatives for both the British exporter and importer.

December 28, 2020

GBP/USD

Source: Net Dania

Implied Volatility

Before we jump to the examples and prices of currency hedging strategies, we will present the implied standard deviation, which is probably the most influential factor in the price of hedges.

6 Month Implied Volatility

Source: Sentry Derivatives

What we can learn from this graph is that Put options prices are more expensive compared to Call options at the same distance from the forward rate. This graph is for half a year, but this is also the case for different time periods, up to a year.

Does this mean that market participants are expecting a decline in the exchange rate? Maybe, but it should not be relevant to the decision of whether to hedge or not. However, this information can have an impact on how to put together a hedging strategy.

Hedging alternatives for a British exporter

Under a working assumption that the current spot rate is considered inconvenient for British exporters, we will represent hedging alternatives that do not include an obligation or include an obligation at a low rate that is considered convenient for an average British exporter.

Exporter, alternative A:

The first hedging alternative is to purchase the Call Vanilla option for a period of six months, at a cost of about 1.976%. This alternative is similar to insurance because it provides protection, and the maximum loss is the premium to be paid when purchasing it.

Given the high cost, it is likely that the average British exporter will reject this alternative. At the same time, it is important to present this alternative, as it is a reference point for the following alternatives.

Exporter, alternative B:

Risk Reversal with limited potential profit

- Protecting from a rate of 1.3650 up, which is 1% higher than the forward rate.

- Limiting the potential profit at the exchange rate of 1.4120.

- Maximum possible profit: 47,000 USD = (1.4120 – 1.3650) X 1,000,000 GBP

- Creating a commitment to buy pounds and sell dollars at a rate of 1.2974, which is considered a convenient rate for the average British exporter.

Strategy cost: 0.62%

Exporter, alternative C:

Knock Out Call

Creating protection with a profit that may be canceled (conditional compensation)

- Protecting from the rate of 1.3639 up, which is 1% higher than the forward rate.

- The profit will be eliminated if at the moment of expiration of the transaction the market rate will be equal to or higher than the trigger rate: 1.4179.

Noth: A European-type trigger is used here. This means that the test of whether the trigger took place or not is carried out at the expiration moment and not during the strategy life.

This is not an ideal hedging strategy, but it is better than doing nothing.

Strategy cost: 0.729%

Exporter, alternative D:

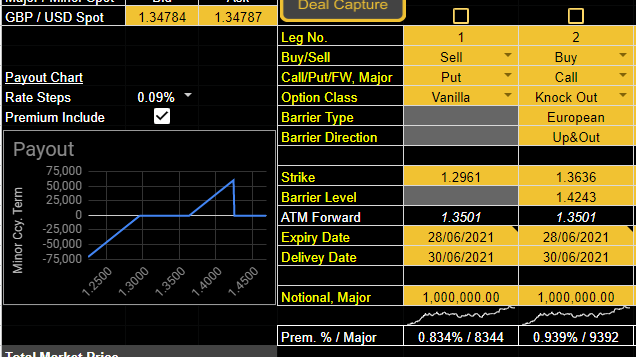

Risk Reversal with conditional profit (profit may be canceled)

This alternative is similar to the previous alternative, with one difference: adding sold Put option at the rate of 1.2961.

That is, creating a commitment to buy pounds and sell dollars at a rate of 1.2961. That is, it will cause a loss from the strategy if the market rate at the expiration is lower than 1.2961.

But it can be assumed that the average British exporter is still profitable at ~ 1.30, so creating such a commitment is a risk that the average exporter can take on himself.

Hedging alternatives for a British importer

Under the working assumption that the spot rate is currently comfortable, here are hedging alternatives, which on the one hand provide relatively close protection to the forward rate and on the other hand also have a contingent liability.

The condition of the contingent liability is that it allows the importer to enjoy a further increase in the exchange rate, without the hedging instrument creating a loss.

Extra Forward with the use of an American trigger

The hedging (protected) rate and the commitment rate are the same in both alternatives and are ~ 1.343

The two strategies cost more or less the same.

The difference is the type of trigger and the trigger rate:

- American Trigger: An obligation to sell a pound will be created if during the strategy life the exchange rate trades at the trigger rate of 1.4090 or above it.

- European Trigger: An obligation to sell a pound will be created if at the expiration date (and moment) the exchange rate is high or equal to the trigger rate of 1.3650.

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a liquidity source for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We offer a derivative pricing calculator. We also offer policy tracker and FX derivatives inventory management tools.