The EUR/CAD implied volatility had gone up, which implies that market participants expect sharp movement. It would be a waste of time to guess where. Are you ready?

Date: Jan 5, 2021

Since August, the sideways movement could put anyone who hedges his exposure to foreign currency to sleep. This is even though the EUR/CAD exchange rate has shown that it can move sharply in short periods.

For example, in a panic that gripped the market in March 2020, the EUR/CAD reached a momentary low of 1.427 that month and rose sharply to a brief high of 1.597, increasing about 12%.

A look at the graph shows that further sharp movements have occurred in previous years.

One of the tools to feel the pulse of market participants is the implied standard deviation. This indicator indicates market participants’ expectations, and it has risen in the last month. This can be interpreted as a sharp movement that is likely to occur. However, it would be a waste of time to guess where.

It is essential to say that this is not an error-free indicator, but what is certain is that it affects the prices of hedging transactions because they are priced based on it.

Source: Netdania

EUR CAD Implied volatility (as of Jan 1, 2021)

Source: Sentry Derivatives

Thus, we will present hedging alternatives for companies that are exposed to each of the directions.

The first alternative, which is also a benchmark for any other alternative, is a simple forward deal.

Here are indications of forward points (Bid/Ask) for different time tenors:

The various hedging alternatives are examples of how company management can look at market direction, including technical analysis aspects.

Given the above, one can notice a resistance level around 1.608 and a support level around 1.53. This data will be one of the considerations in the currency hedging ideas below.

Hedging ideas for a company that is exposed to the appreciation of the euro against the Canadian dollar

Risk reversal (Direction up ↑)

Given the forward rate for July 14, 2021: 1.5701 (spot 1.564)

- Protection: Right to buy euros and sell Canadian dollars at the exchange rate of 1.5858.

- Obligation: Obligation to buy euros and sell Canadian dollars at the exchange rate of 1.5591.

Cost: 0.054%

Risk reversal with a limited profit (Direction up ↑)

The idea underlying this alternative is that if we limit the potential compensation, we can move down the Put option strike, thus reducing this strategy’s risk.

The maximum profit strike is above the technical resistance level of 1.608.

- Protection: Right to buy euros and sell Canadian dollars at the exchange rate of 1.5810. The maximum profit strike is above the technical resistance level of 1.608.

- Maximum potential profit payout: 1,000,000 EUR x ( 1.6223 – 1.5810) = 41,300 CAD.

- Obligation: Obligation to buy euros and sell Canadian dollars at the exchange rate of 1.5387.

Cost: 0%

Hedging alternatives for a company that exposed to the devaluation of the euro against the Canadian dollar

Risk reversal (Direction up ↓)

Given the forward rate for July 14, 2021: 1.5699 (spot 1.5641)

- Protection: Right to sell euros buy Canadian dollars at the exchange rate of 1.5542.

- Obligation: Obligation to sell euros and buy Canadian dollars at the exchange rate of 1.5816.

Cost: 0%

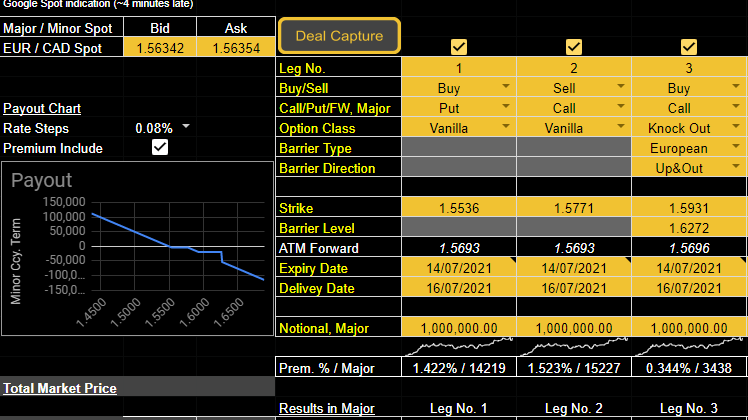

Risk reversal with a limited but conditional loss (Direction up ↓)

Given the forward rate for July 14, 2021: 1.5693 (spot 1.5365)

- Protection: Right to sell euros buy Canadian dollars at the exchange rate of 1.5771.

- Obligation: Obligation to sell euros and buy Canadian dollars at the exchange rate of 1.5536.

- Conditional limited loss (Trigger dependent): Right to buy euros sell Canadian dollars at the exchange rate of 1.5797.

- Maximum loss* = 1,000,000 EUR X (1.5771 – 1.5931) = – 16,000 CAD.

- *Limited loss knockout: If at the expiration, the spot rate is high or equal to the trigger rate of 1.6272, then the limited loss element will be eliminated! It can be noted that the trigger rate is placed above the technical resistance level of 1.60.

- The obligation to sell euros and bu

- Maximum loss* = 1,000,000 EUR X (1.5771 – 1.5931) = – 16,000 CAD.

Cost: 0.243%

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a liquidity source for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We offer a derivative pricing calculator. We also offer policy tracker and FX derivatives inventory management tools.