by abdulmotin | Mar 24, 2025 | Blog

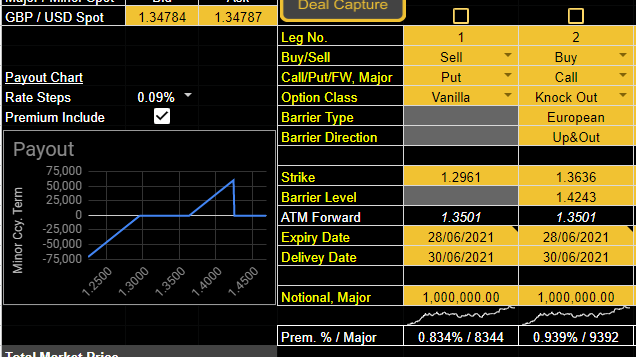

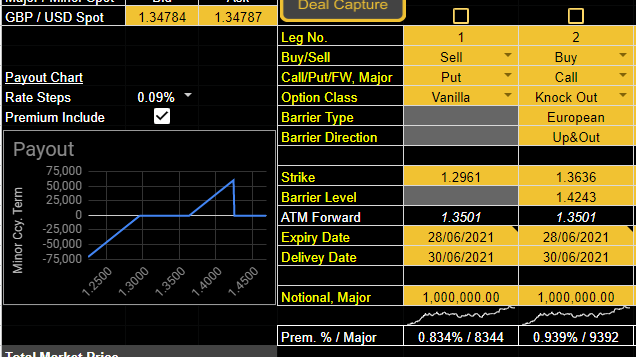

GBP / USD market condition and currency hedging alternative ideas Since the low point recorded in March 2020, the pound has strengthened against the dollar, also on the background of the dollar weakening against major currencies. A state of a strong pound against the...

by abdulmotin | Mar 24, 2025 | Blog

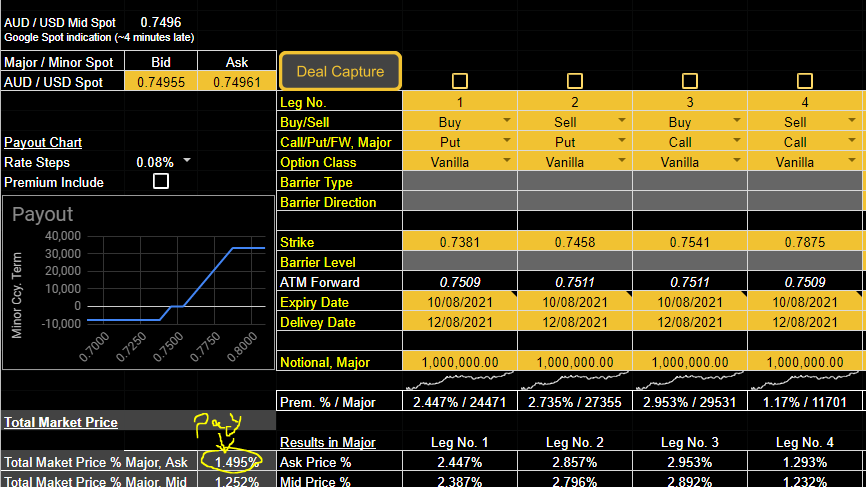

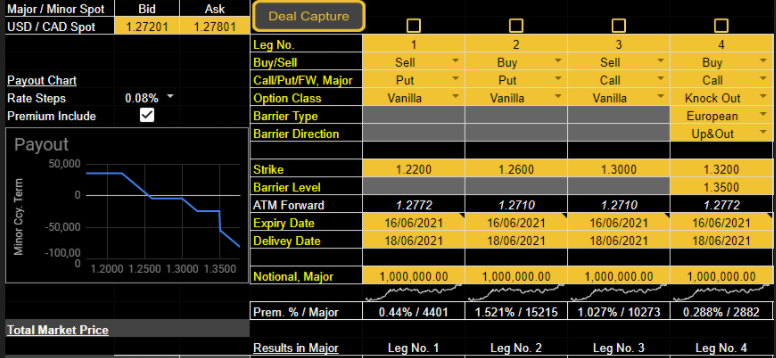

FX hedging & position management FX hedging in extreme conditions #2# In practice, companies tend to “freeze” when the exchange rate moves consistently and sharply in the exposure direction. This is not a situation that should occur because a company...

by abdulmotin | Mar 24, 2025 | Blog

Companies should hedge exposure to foreign currency in any market situation. However, in practice, companies “freeze” when the exchange rate moves consistently and sharply in the exposure direction. The fear of fixing an exchange rate, which is bad for the...

by abdulmotin | Mar 24, 2025 | Blog

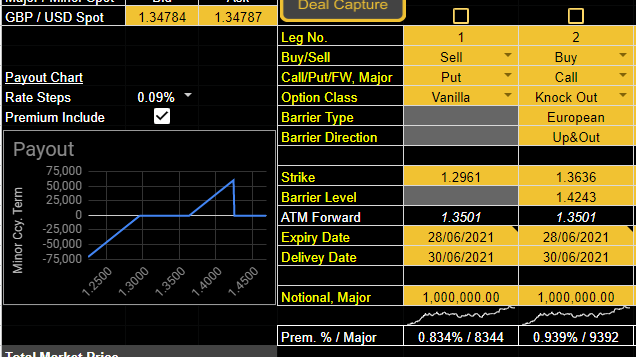

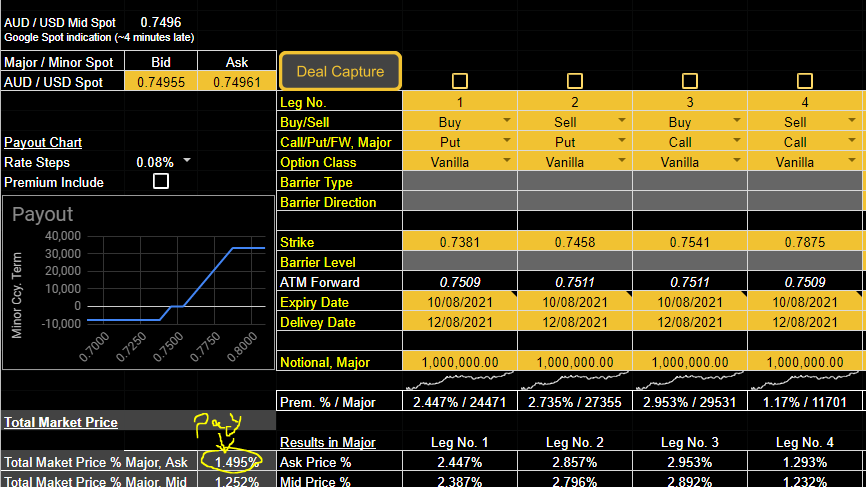

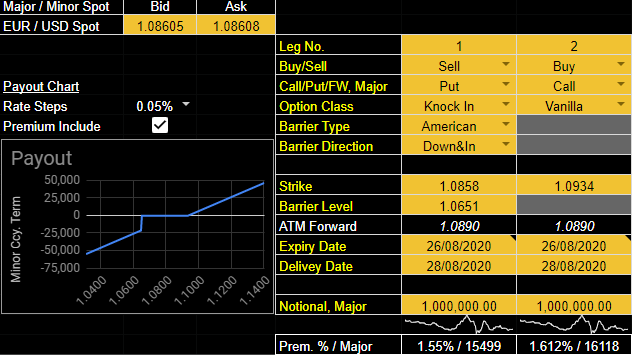

Importer / Exporter – Did you know that the “Smile” is smiling at you these days? The parameter that most influences the option price for a given time is the standard deviation, also known as volatility. The higher the volatility, the higher the option price. If...

by abdulmotin | Mar 24, 2025 | Blog

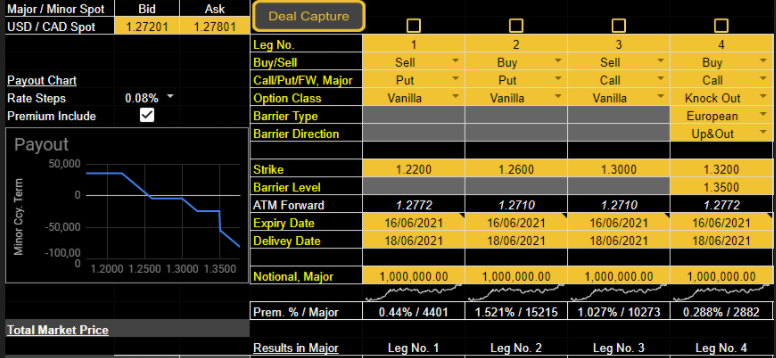

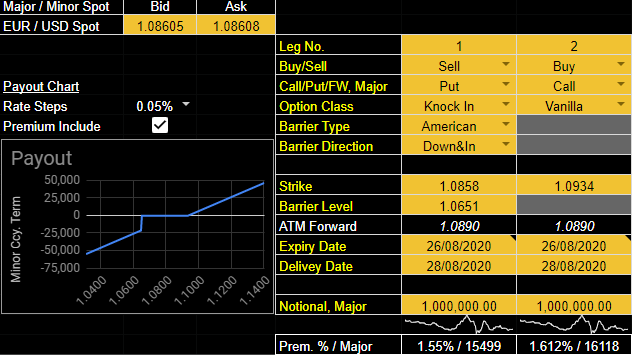

What can a CFO (or treasury) do now to hedge FX exposure given the market situation? For several months now, we have been witnessing an uptrend in the Euro / Dollar pair. I write it in the past tense because apparently, the trend has come to an end. November...

by abdulmotin | Mar 24, 2025 | Blog, Hidden pages

Estimating the fair value of different equity share classes Privately held companies often exhibit capital structures that are comprised of several classes of equity (usually common equity and preferred equity). The equity classes enjoy different privileges, with...