FX DERIVATIVES PRICER

FAQ

What are the calculator uses?

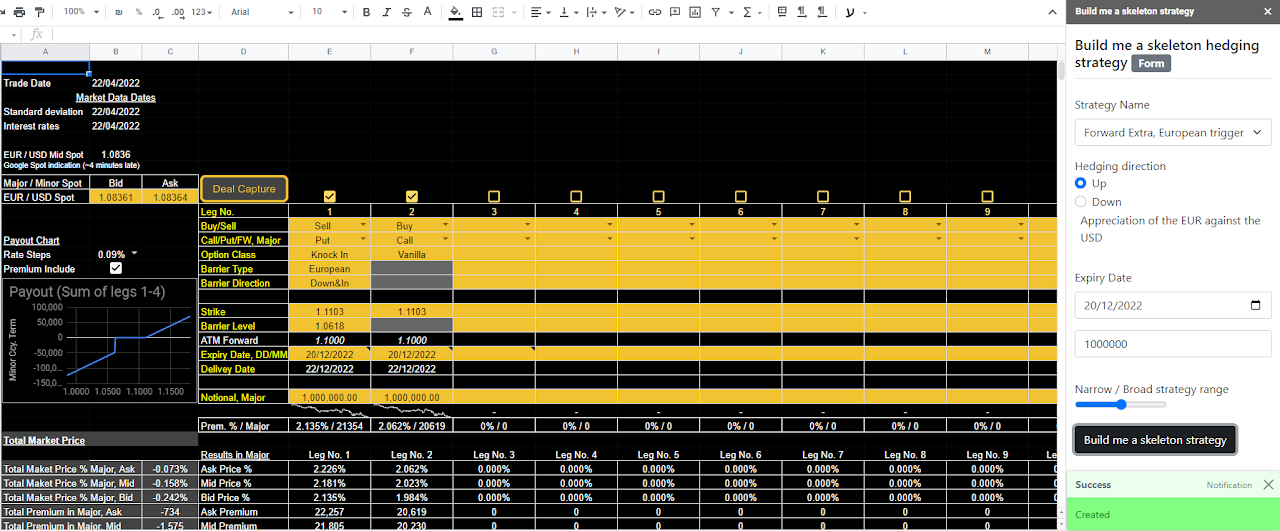

- The pricer assists in planning and examining hedging strategies alternatives before execution

- Determine the derivatives market price for financial reporting

This calculator is exactly what corporations use and need to better plan their hedging activities. The calculator’s greatest advantage is that it includes high-quality and up-to-date market data. Market data refers mainly to standard deviations (volatility) and interest rates.

What can it do?

FX Derivative pricing calculator, including OTC market data

-

Deal Type: Forward / Call / Put

-

Option Class: Vanilla / Knock in / Knock out

-

Barrier Type: American / European

-

Barrier Direction: Up&In / Up&Out / Down&In / Down&Out

-

Payout Chart

-

Simultaneous pricing of up to 24 “legs”

-

Automatic hedging strategies builder

What are its outstanding advantages

- The calculator’s greatest advantage is that it includes high-quality and up-to-date market data.

- The calculator is implemented in Google Sheets. No installation is required.

- The calculator is available in all Google applets, on your computer, tablet, or cell phone.

- So far, such a calculator has been the privilege of wealthy companies. But now, SMEs can also access the world of OTC derivatives.

Delivery Method and Time

The customers choose one currency pair and provide us with their Gmail address, and we share the calculator with them. The customer will be asked to fill in this information as part of the store purchase flow.

- Setup time: up to two business days.

- Subscription period: 30 days after the setup is completed.

FX Options calculator (pricer) with OTC market data

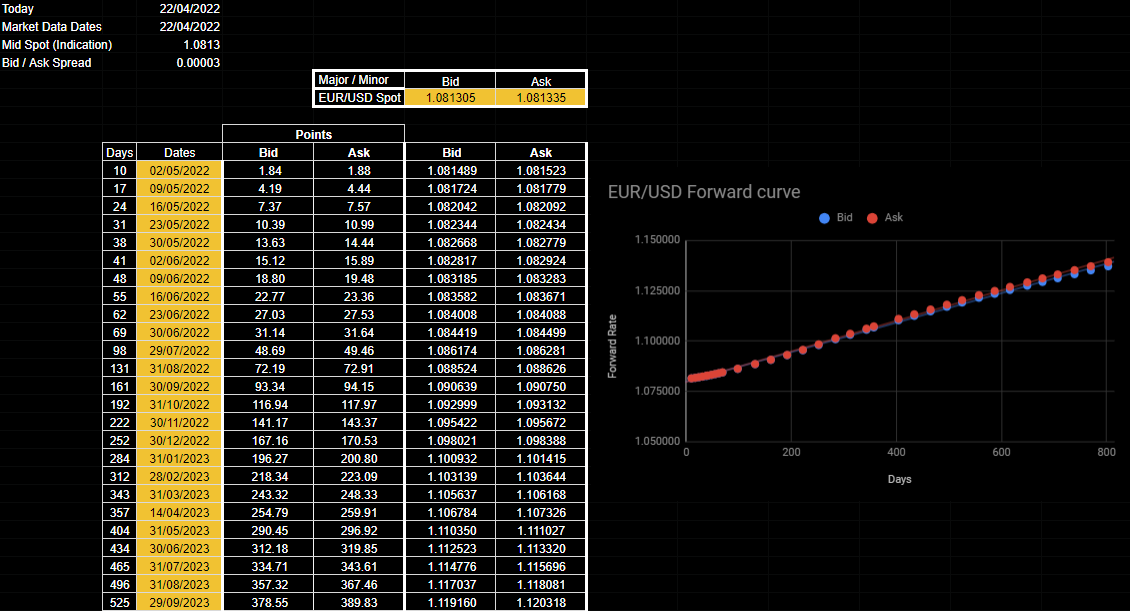

FX Forward points | FX Forward rates | FX Forward curve