The EUR/USD exchange rate is currently undergoing technical correction as part of an upward trend. What are the hedging alternatives for importers and exporters today?

In November 2020, the EUR / USD exchange rate seemed to have reached the end of the upward trend. But then reminded us that the currency market is unpredictable and then went out for another sprint as part of an uptrend.

Published: January 14, 2021

Importers and exporters are supposed to hedge currency exposures based on a defined risk management policy and therefore also perform hedging actions in any market situation. The freedom degrees that the executing team can have may be related to the preferred hedging tool, but not to the question of whether to hedge or not. Technical analysis, for example, can be one of the considerations of the execution team when choosing hedging tools.

The actual application of selecting a hedging instrument is also expressed in the use of option-based hedging transactions since such transactions make it possible to create a chance/risk structure that is tailored to the unique needs of the hedging company.

The following are hedging ideas for importers and exporters, given current market conditions.

EUR/USD, weekly chart

Source: NetDanie

- Resistance level: 1.253

- The first support level: 1.2050

- The second support level: 1.18

A hedging alternative for a company that is exposed to the depreciation of the euro against the dollar

Assuming the market rate today is considered a “better” rate compared to the hedging company budget rate, it is possible to create a hedging strategy that will both provide relatively close protection to the forward rate and also provide an upside if the exchange rate goes up slightly.

FX Forward Extra:

Hedging strategy components explanation:

- Protection from rate 1.2141 downwards. This rate is only 0.5% far from the forward rate. That is, the right to sell euros and buy dollars at the rate of 1.2141.

- An obligation to sell the euro and purchase a dollar at the rate of 1.2141, only if at the transaction expiration agreed time, the spot rate will be equal to or higher than the trigger rate of 1.243.

Cost: 0.025% (pay 255 EUR for transaction amount of 1 million EUR).

Hedging alternatives for a company that is exposed to the appreciation of the euro against the dollar.

The reality is probably more complex for companies that are exposed upwards in this pair of currencies. This is why we will present a number of currency hedging alternatives.

Risk Reversal:

Hedging strategy components explanation:

Create a 2% indifference range around the forward rate (1% in each direction).

- Protection from rate 1.2328 upwards. This rate is 1% higher than the forward rate. Right to buy euros and sell dollars at 1.2328.

- Obligation to buy euros and sell dollars at 1.2083. This rate is 1% lower than the forward rate.

Cost: 0.08%

Risk Reversal with a limited potential loss:

Hedging strategy components explanation:

- Protection from rate 1.2383 upwards. This rate is 1.5% higher than the forward rate. Right to buy euros and sell dollars at 1.2383.

- Obligation to buy euros and sell dollars at 1.2115. This rate is 0.7% lower than the forward rate.

- Limiting the potential loss: Right to sell euros and buy dollars at 1.1991.

- Maximum pottantisal loss (pauout) = -12,400 USD = (1.1991 – 1.2115)X1,000,000 EUR

Cost: 0.864%

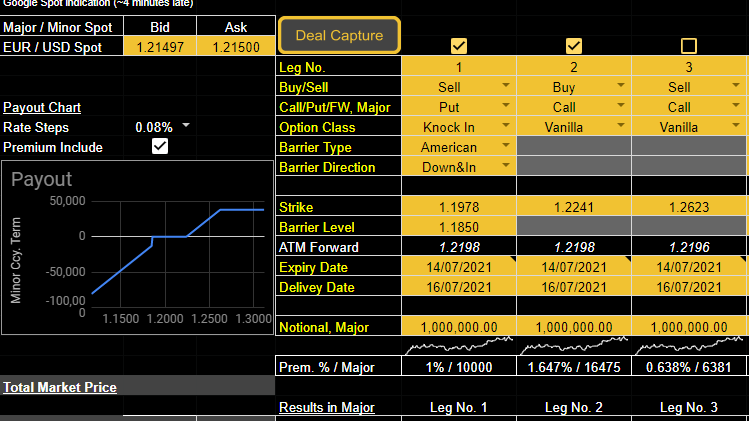

Risk Reversal Extra with a limited profit

If a company budget rate is for example 1.20, follow the following strategy at zero cost:

Hedging strategy components explanation:

- Protection from rate 1.2241 upwards. This rate is 0.35% higher than the forward rate. Right to buy euros and sell dollars at 1.2241.

- Limited potential profit: obligation to sell euros and buy dollars at 1.2623 (+3.5% above the forward rate). It should be noted that this rate is above the technical resistance than rate.

- Maximum profit = 38,200 USD = (1.2623 – 1.2241) x 1,000,000 EUR.

- Obligation: creating an obligation below the budget rate (1.20)! Therefore this is a risk that the company can probably take. Obligation to buy euros and sell dollars at 1.1978. This obligation will take effect (knockin) only if during the strategy life the exchange rate trades at least once at the trigger rate of 1.185, or below this rate.

Cost: Zero cost (0.009%)

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a liquidity source for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We offer a derivative pricing calculator. We also offer policy tracker and FX derivatives inventory management tools.