FX hedging & position management

FX hedging in extreme conditions #2#

In practice, companies tend to “freeze” when the exchange rate moves consistently and sharply in the exposure direction. This is not a situation that should occur because a company needs to formulate an FX risk management policy, according to which it must hedge its FX exposure in any market situation in pre-determined percentages. But the reality can not be ignored because companies simply “freeze” from the fear of fixing an exchange rate that is considered “bad” for them.

This article can be seen as a follow-up to an article published last week. The difference is that in this article, we will present a scenario according to which the company already has hedging transactions that have been created in the past and how they can be used to finance a new hedging transaction (or new transactions).

AUD/USD, Weekly chart

Source: netdania

Example:

The company has an existing hedging transaction, which was executed on July 6, 2020.

- Transaction Type: Buy Forward AUD / USD

- Notional: 1,000,000 AUD

- Expiry: July 6, 2021 (1 Year)

- Forward rate: 0.6902

New FX hedging strategy:

- Today’s Spot rate: 0.7478 ~

- The company is interested in entering into a new hedging transaction which will expire on August 10, 2021, at the notional amount of 1,000,000 AUD. The hedging transaction must provide protection against continued AUD appreciation against the USD.

- Yet, the company fears a trend reversing scenario and therefore not interested in executing a buy forward transaction that will fix the forward rate for September 2021, which is about 0.7510.

What alternatives out there to limit the risk from the hedging instrument in a trend reversal scenario?

Alternative 1: Buy call option

The alternative of buying a Call option was rejected in light of the high cost.

A Call strike which is higher than the forward rate by 0.5% cots 2.904% (29,041 EUR).

Various techniques for FX hedging in extreme conditions were presented, as mentioned, in an article that was published last week.

Alternative 2:

Limit the potential profit for existing hedging strategy → Receiving a premium → Use the premium received to create a new hedging transaction with a limited potential loss

In this article, we will present how the company can use the forward deal executed on July 6, 2020, to fund a new limited risk strategy for August 10, 2021.

Step 1:

- We are limiting the Forward (created on July 6, 2020) potential profit.

- Doing so by selling a call option at a higher strike by 3% from the current forward rate, to the same delivery date (Jul 6, 2021).

- Receiving a premium of about 1.5%

An aggregate payoff graph to Jul 6, 2021:

The maximum potential profit:

1,000,000 AUD * ( 0.7732 – 0.6902) = 83,000 USD

Step 2

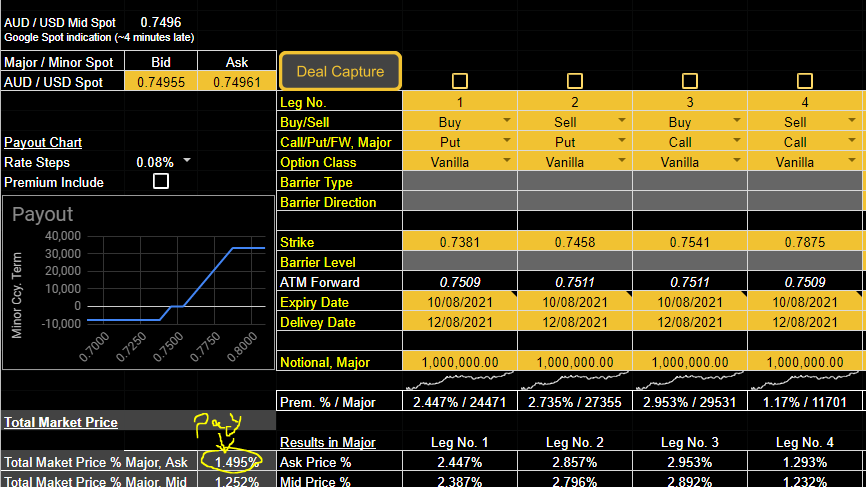

Creating a new hedging transaction, expiry: August 10, 2021.

Strategy components:

- Buying a call option at strike 0.7541 – protection from AUD appreciation. Protection is very close to the forward rate (just 0.4% above).

- Selling a call option at a strike of 0.7875, and by doing so by limiting the potential profit. Maximum potential profit: 1,000,000 AUD – (0.7875-0.7541) = 33,400 USD.

- Selling a put option at a strike of 0.7458 and limiting the potential loss till 0.7381, by buying a put option as that strike. The maximum potential loss is 1,000,000 AUD * (0.7381-0.7458) = 7,700 USD.

This strategy costs about 1.5% and is funded by the sold call option (see Step 1).

Conclusions:

- There are hedging alternatives ,even when it seems that there is no longer any point in hedging currency exposure.

- The importance of planning FX hedging tools is very clear these days.

- Each company has a different risk appetite and unique needs. Therefore, it is important to have a derivative pricing calculator and to explore alternatives at ease and with discretion.

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a liquidity source for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We offer a derivative pricing calculator. We also offer policy tracker and FX derivatives inventory management tools.