Companies should hedge exposure to foreign currency in any market situation. However, in practice, companies “freeze” when the exchange rate moves consistently and sharply in the exposure direction. The fear of fixing an exchange rate, which is bad for the company, causes the company to suspend hedging operations and wait.

> But how long to wait?

> What are the alternatives?

December 14, 2020

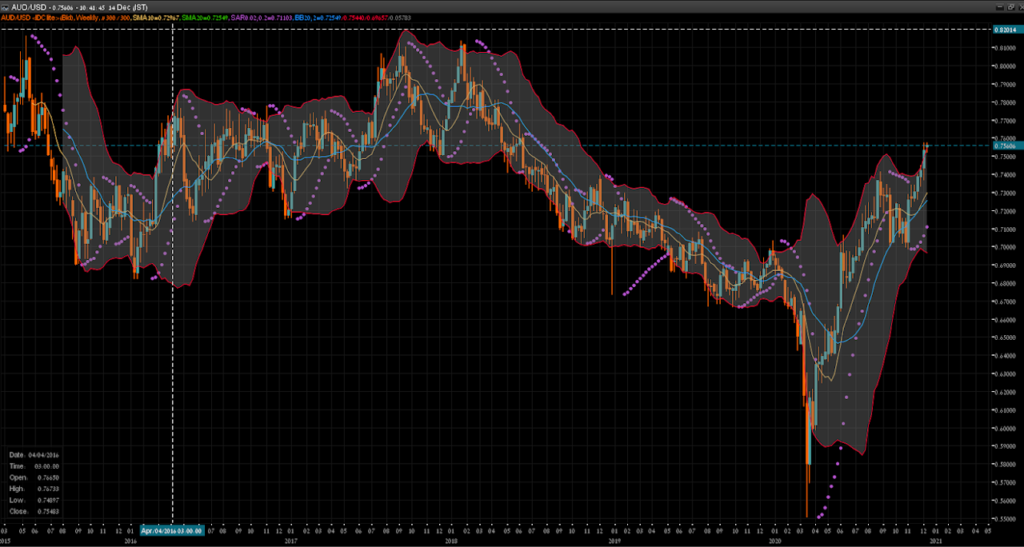

Example: USD/CAD, Weekly graph

Source: Netdania

Since the peak in March 2020, when the exchange rate touched the rate of 1.465 for a moment, the USD / CAD exchange rate has been falling steadily, in light of the USD depreciation trend against the other major currencies.

One of the technical signs that state the dollar is in an “over-selling” situation is the exit of the exchange rate from the Bollinger Bands area, which occurred two weeks ago and a week ago. Bollinger Bands’ range of two standard deviations represents a range in which an exchange rate should be traded at the probability of about 95.4%. The exit of an exchange rate outside the Bollinger Bands has a probability of 4.6%.

If the technical oscillators also point to over-sales of the dollar, it is not surprising that many companies tend to suspend hedging operations when an exchange rate is traded in the direction of their exposure. But is this right in the aspect of risk management?

I think not, because a situation of overselling can last a long time, even several weeks in a row.

Companies should hedge in any market situation, in percentages that reflect their policies!

The company’s freedom degrees should be in choosing the hedging tools, not in deciding whether to hedge or not. The application of this is necessarily making use of hedging strategies based on options and not just forwards.

Well, what are the alternatives?

(While remembering that there are support levels at 1.25 and additional support levels at 1.227)

Example 1:

A company that is very afraid of a rebound in an exchange rate, can purchase a Put option.

If the Puy vanilla option is too expensive for her (~ 1.444%), she should consider Put with Knockout.

The price differences, in this example (half a year), are significant. Put vanilla costs about 1.44%, while Put with Knockout in the same Strike, and canceled if an exchange rate hits Trigger 1.215 during the half-year – costs about 0.127%.

Example 2:

If Put spread is too expensive (0.836%) or the compensation potential is too low for the company, she should consider Risk reversal with limited profit.

Compensation is not conditional but simply limited.

Risk reversal with limited profit: Limiting the potential compensation will make it possible to increase the compensation potential compared to the Put spread and also create a liability (due to the sold call) up to 1.31. In an upward rebound scenario, the company will be able to enjoy an exchange rate increase up to 1.31. This strategy should cost 0.048% (compared to 0.836%).

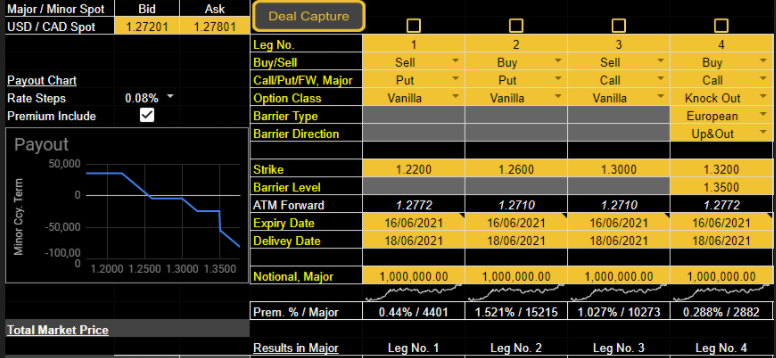

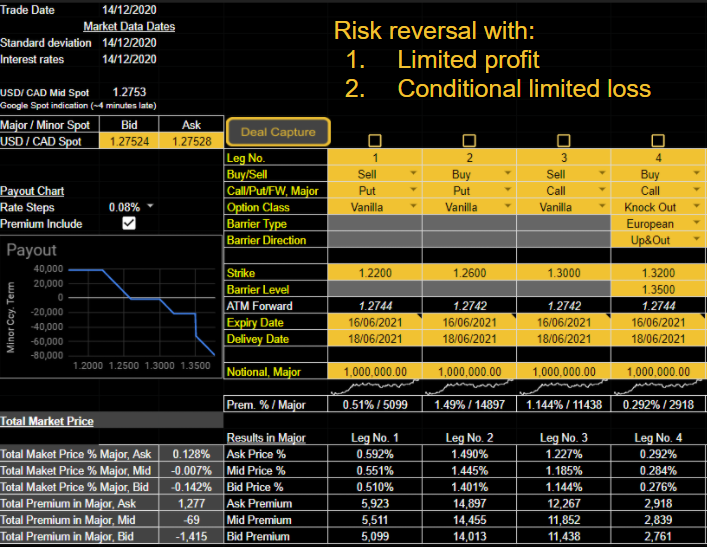

Example 3:

Risk reversal with limited profit and conditional limited loss

- Exchange rate protection from 1.26 and below, up to 1.22. The profit potential is limited (unconditional).

- Obligation to sell dollars at 1.30. The company can enjoy an upward trend until 1.30 without the hedging tool creating a loss.

- If the exchange rate goes up beyond 1.30, the hedging strategy will create a loss. However, the loss is limited to the rate of 1.32, provided that at the transaction expiration the exchange rate will not be higher than or equal to the Trigger rate of 1.35.

Cost: 0.128%

This technique may be relevant to other currency pairs these days.

For example, AUD / USD, Weekly graph

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a liquidity source for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We offer a derivative pricing calculator. We also offer policy tracker and FX derivatives inventory management tools.