What can a CFO (or treasury) do now to hedge FX exposure given the market situation?

For several months now, we have been witnessing an uptrend in the Euro / Dollar pair. I write it in the past tense because apparently, the trend has come to an end.

November 25, 2020

Chart source: NetDania

From a technical point of view, there are a number of indicators that indicate this.

- For several months the short moving average was above the long, as evidence of an upward trend. Now they are going to swap the position between them.

- The Parabolic Sar changed its position a few weeks ago, from a position below the candle (characteristic of an uptrend), to above the candle.

- The momentum oscillators RSI, MACD are uneven in their reading. Typical of the sideway trend.

All this still does not mean that the trend has been reversed. We are going for a certain period of sideways trend according to the technical definition, and this before it will be possible to define what the new trend is.

What does all this mean for a company that hedges its currency risks?

The truth is that not much… what’s more, that no one really has any idea about shot-medium exchange rate fluctuations. From a technical point of view, in a period of the sideway trend – it is not even possible to make an intelligent guess.

If we put all this aside, companies should hedge in any market situation, in percentages that reflect their policies!

The freedom degrees of the company should be in choosing the hedging tools, and not in deciding whether to hedge or not. The application of this is necessarily making use of hedging strategies based on options as well, and not just forwards.

Example:

Suppose two CFOs of two companies agree that the dollar will continue to depreciate against the euro (increase (↑) in the EUR/USD exchange rate).

- Both managers must hedge in light of risk management policies. However, the board authorized them to make a decision regarding the choice of hedging tools.

- Company A, exposed to an increase (↑) in the EUR/USD exchange rate. Company B is exposed to the exchange rate decline (↓).

What can Company A’s CFO do?

What can Company B’s CFO do?

Company A’s CFO hedging strategy:

- Implement a wide risk reversal.

- In this way, he will sell a low rate put which will reduce the probability that it will be realized.

- The company will be able to enjoy an exchange rate drop, from spot 1.1910 (or forward rate of 1.1965) till the put strike 1.1825 without the strategy causing a loss.

- The hedge will only be from the call strike 1.2150 and above, but this is in line with the CFO’s belief that the trend is downward.

- Such a hedging strategy for half a year will be at about zero cost, given the pricing parameters.

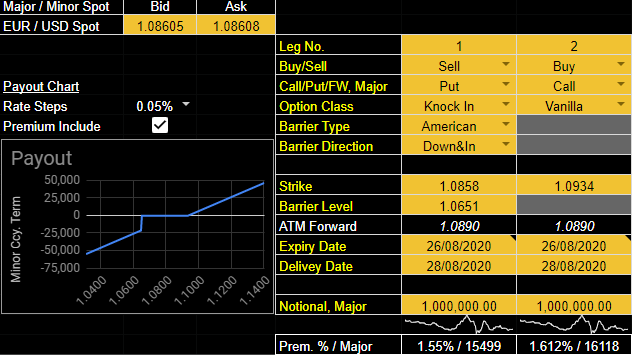

Company B’s CFO hedging strategy:

Since the CFO believes the market trend is downward, he can execute a Forward Extra hedging strategy.

This way he will get a hedging rate (1.1908) that is very close to the forward rate (1.1962). And if he turns out to be wrong about the market trend, the exchange rate can still go up till the Trigger rate (1.2150) without the hedging strategy causing a loss.

Such a hedging strategy for half a year will be at about zero cost, given the pricing parameters.

Disclaimer:

This post does not constitute advice or recommendation.

Anyone who uses the information presented here does so at his own risk.

‘Calc fellow’ is not a consulting firm and does not provide a source of liquidity for derivative transactions.

‘Calc fellow’ provides tools to companies to help them manage their currency risks (Software as a service). We provide a derivative pricing calculator. We also provide policy tracker and FX derivatives inventory management tools.